Everything You Need to Know About Severance Packages, State Laws, and Unemployment Benefits

Losing a job is one of life’s most stressful experiences. When it happens, two urgent questions often dominate your mind: Will I receive severance pay? And can I still collect unemployment benefits? The answers depend heavily on your state, your employer, and how your separation is structured — and getting it wrong could cost you thousands of dollars.

This comprehensive guide breaks down everything U.S. workers and HR professionals need to know about severance pay and unemployment insurance in 2026 — including how severance affects unemployment eligibility, state-by-state rules, how to calculate severance, and what steps to take after job loss to protect your financial well-being.

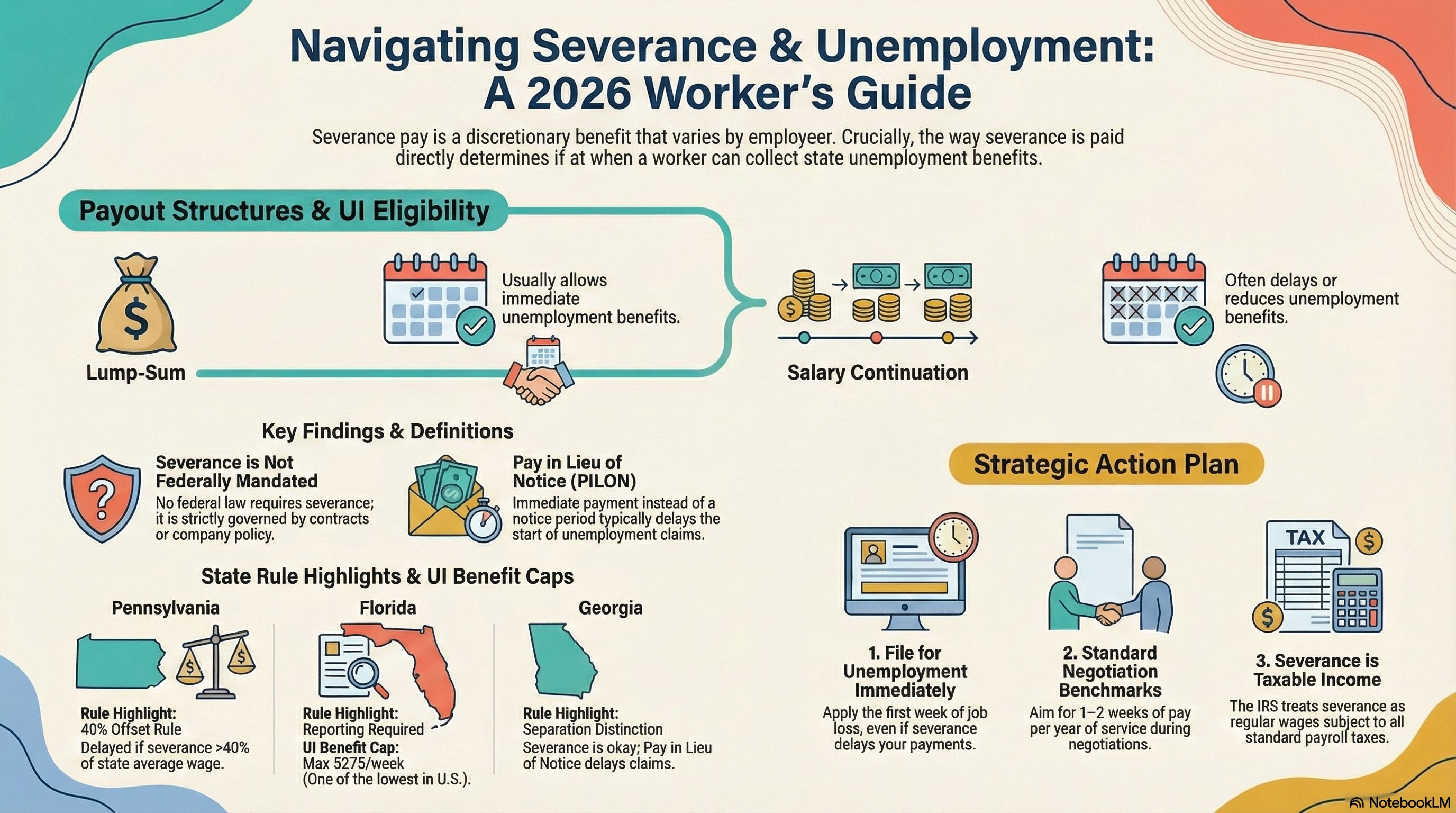

Key Takeaway: In most U.S. states, receiving a lump-sum severance payment does NOT automatically disqualify you from collecting unemployment benefits — but the rules vary significantly by state and how the payment is structured.

What You Will Find in This Guide

- What Is Severance Pay? Definitions and Types

- Is Severance Pay Required by Law?

- How Does Severance Pay Affect Unemployment Benefits?

- State-by-State Severance and Unemployment Rules

- Pennsylvania: Severance Pay and Unemployment

- Florida: Severance Pay and Unemployment

- Georgia: Severance Pay and Unemployment

- How to Calculate Your Severance Pay

- Severance Pay Taxes: What to Expect in 2026

- Negotiating Your Severance Package

- What to Do After Receiving Severance

- Frequently Asked Questions

1. What Is Severance Pay? Definitions and Types

Severance pay is compensation provided by an employer to an employee upon termination of employment. It is typically offered in situations involving layoffs, company downsizing, restructuring, or mutual separation agreements. It is not the same as a final paycheck (which covers wages already earned) and should not be confused with accrued vacation payout.

Common Types of Severance Packages

- Lump-Sum Payment: A single payment of the full severance amount, paid out all at once

- Salary Continuation: Regular paycheck-style payments made over a set period (e.g., weekly for 8 weeks)

- Pay in Lieu of Notice (PILON): Immediate payment instead of requiring the employee to work a notice period

- Enhanced Severance: Additional benefits such as health insurance continuation, outplacement services, or stock vesting

Understanding which type of severance you are receiving is critical, because the payout structure — lump-sum versus salary continuation — has a direct and dramatic effect on your unemployment insurance eligibility in many states.

Pro Tip: Always get your severance agreement in writing. The document should specify: the total amount, payment schedule, whether benefits continue, and what rights you may be waiving (such as the right to sue).

2. Is Severance Pay Required by Law in the United States?

No federal law in the United States requires private-sector employers to provide severance pay. The Fair Labor Standards Act (FLSA) does not mandate severance, and neither does any other federal statute. Severance is entirely discretionary — unless:

- Your employment contract explicitly guarantees severance pay

- A collective bargaining agreement (union contract) requires it

- Your employer’s written policy promises it

- An oral promise of severance was made (this can be harder to enforce)

Under the federal WARN Act (Worker Adjustment and Retraining Notification Act), employers with 100+ employees must give 60 days advance notice before mass layoffs or plant closings. If they fail to provide this notice, they may owe back pay and benefits for up to 60 days — which is sometimes structured similarly to severance. Some states also have their own mini-WARN acts with different thresholds.

When Employers Typically Offer Severance

- Mass layoffs or organizational restructuring

- Elimination of a position or department

- Early retirement incentive programs

- Mutual agreement to end employment

- When asking employees to sign a release of claims

3. How Does Severance Pay Affect Unemployment Benefits?

This is the most searched and most misunderstood aspect of severance pay. The core question: If I receive severance, can I still collect unemployment insurance (UI)?

The answer is: it depends on your state and the structure of your severance. Here is the general framework that most states follow:

| Severance Type | Most States | Some States |

| Lump-Sum Payment | No effect on UI eligibility | May delay UI start date |

| Salary Continuation | May reduce or delay UI benefits week-by-week | Treated same as wages |

| Pay in Lieu of Notice (PILON) | Delays UI start by weeks covered | Varies by state |

| Enhanced Benefits Only | Generally no effect | Generally no effect |

In states that treat severance as “wages” for UI purposes, receiving a salary continuation payment during a given week could either reduce your UI benefit for that week or disqualify you entirely until the continuation period ends. In contrast, lump-sum payments are typically not considered ongoing wages and therefore do not affect your weekly UI benefit amount.

Important: You must still file for unemployment benefits promptly after job loss even if you are receiving severance. Most states have a waiting period before benefits begin, and delaying your application can result in lost benefits that cannot be retroactively paid.

4. State-by-State Severance and Unemployment Rules

The United States has 53 separate unemployment insurance systems — one for each state, plus Washington D.C., Puerto Rico, and the U.S. Virgin Islands. Each state sets its own rules about how severance pay interacts with UI benefits. Below, we focus on the three most-searched states based on real user data.

Pennsylvania: How Severance Pay Affects Unemployment

Pennsylvania has some of the most important and specific rules in the country regarding severance and unemployment — and thousands of workers search for this information every month after receiving a severance package.

Under Pennsylvania law (43 P.S. § 804(e)), severance pay can affect your unemployment benefits depending on the amount. Here is how the Pennsylvania Department of Labor & Industry applies the rules:

- If your severance pay is more than 40% of the Pennsylvania Average Annual Wage (approximately $45,000–$50,000 in recent years), the excess amount is allocated as wages over the period it represents and will delay the start of your UI benefits.

- If your severance is equal to or less than 40% of the state average annual wage, it generally does not affect your UI eligibility.

- The allocation period is calculated by dividing the excess severance amount by your weekly wage to determine how many weeks of UI are delayed.

Pennsylvania treats severance paid as a lump sum differently from ongoing salary continuation. A lump sum that meets the 40% threshold will be prorated and offset UI benefits for the calculated number of weeks, after which you can begin receiving full UI.

Pennsylvania Example: If you earned $1,000/week and received a $20,000 lump-sum severance, and the threshold is $18,000 (40% of average annual wage), the excess $2,000 would delay your UI benefits by 2 weeks.

Key action step for Pennsylvania workers: File for unemployment as soon as you are separated from your employer, even if you know severance will delay your benefits. The Pennsylvania UC service center will calculate the offset period for you. Do not wait — filing late can result in permanently lost benefits.

Florida: Severance Pay and Unemployment Insurance

Florida is a state with relatively straightforward rules when it comes to severance and unemployment — which is why it attracts so many searches from workers facing job loss.

Florida’s Reemployment Assistance Program (formerly called Unemployment Compensation) does NOT automatically disqualify you from benefits just because you received severance pay. However:

- If severance is paid as a salary continuation (i.e., your employer continues paying your regular salary for a period), those payments may be considered “wages” and could offset your weekly benefit amount during that period.

- Lump-sum severance payments in Florida are generally not considered disqualifying wages and do not reduce your weekly UI benefit.

- Florida requires you to report any severance payments when you file your UI claim. Failure to report can result in penalties and overpayment demands.

Florida calculates your weekly benefit amount (WBA) as roughly 1/26th of your wages in your highest-earning quarter, up to a maximum of $275 per week — one of the lower caps in the country. This makes it especially important for Florida workers to negotiate a strong severance package, as UI alone may not cover basic expenses.

Florida Tip: Florida’s $275/week maximum UI benefit is one of the lowest in the nation. If you are negotiating severance, aim for as much as possible — at least 2–4 weeks per year of service is a common benchmark.

Georgia: Severance Pay and Unemployment

Georgia workers face similar questions about severance and unemployment eligibility. Georgia’s Department of Labor administers unemployment insurance, and the state has its own rules about how severance interacts with UI.

In Georgia, the key distinction is between:

- Dismissal Pay / Severance Pay: Generally does not prevent you from filing for and receiving unemployment benefits in Georgia, as long as you are otherwise eligible (i.e., you were laid off rather than fired for cause).

- Pay in Lieu of Notice: If your employer pays you wages instead of requiring you to work out your notice period, those payments may delay the effective date of your unemployment claim by the number of weeks covered.

Georgia calculates your weekly benefit using a formula based on your highest-earning quarter in the base period, with a maximum weekly benefit of $365. Benefits can be collected for up to 14–26 weeks depending on the state unemployment rate.

For Georgia workers who were terminated for a reason they believe was unjust or discriminatory, it is especially important to understand the difference between a severance agreement — which often requires you to waive your right to sue — and filing a claim with the EEOC or pursuing other legal remedies.

5. How to Calculate Your Severance Pay

There is no single universal formula for severance pay in the United States. However, there are common industry standards and benchmarks that most HR departments and employment attorneys reference:

Standard Severance Formulas

- One Week Per Year of Service: The most common baseline, especially for non-exempt hourly workers

- Two Weeks Per Year of Service: More common for salaried exempt employees and white-collar positions

- One Month Per Year of Service: Typically reserved for senior executives or very long-tenured employees

A few other factors can affect the final severance amount:

- Job level and title (executives typically receive more generous packages)

- Whether you are signing a release of legal claims (employers often pay more for a broader release)

- Your years of service at the company

- Local cost of living and industry norms

- Whether you had a prior employment contract specifying severance terms

Severance Calculation Example

| Employee Profile | Formula | Estimated Severance |

| 5 years, $52,000/year salary | 1 week per year | $5,000 (5 × $1,000/wk) |

| 5 years, $52,000/year salary | 2 weeks per year | $10,000 (10 × $1,000/wk) |

| 10 years, $80,000/year salary | 2 weeks per year | $30,769 (20 × $1,538/wk) |

| 15 years, $120,000/year salary | 1 month per year | $150,000 (15 × $10,000/mo) |

Use an online severance pay calculator to quickly estimate your package based on salary, tenure, and payment structure. Many HR software platforms — including workforce management tools — provide built-in calculators to help employees and HR teams model different scenarios before finalizing an agreement.

6. Severance Pay Taxes: What to Expect in 2026

Severance pay is taxable income. The IRS treats it the same as regular wages, which means:

- Federal income tax is withheld at your regular wage withholding rate (or at a flat 22% supplemental rate for lump sums over $1 million)

- Social Security tax (6.2%) applies up to the 2026 wage base of $176,100

- Medicare tax (1.45%, plus 0.9% additional for high earners) applies

- State income tax applies in most states

The tax treatment is the same whether severance is paid as a lump sum or as salary continuation. However, the timing matters: a lump-sum payment in December could push you into a higher tax bracket for that year, whereas salary continuation payments spread over the following year may be taxed at a lower rate if your overall income drops after job loss.

Tax Strategy Tip: If you receive a large lump-sum severance in Q4, consider whether it is worth requesting the salary continuation option to spread the income into the next tax year. Consult a CPA or tax advisor for personalized guidance.

One important exception: if your employer contributes to a health Reimbursement Arrangement (HRA) or Health Savings Account (HSA) as part of your severance, those contributions may be tax-free up to annual limits. Always review the full components of your severance package with a financial advisor.

7. How to Negotiate Your Severance Package

Many workers do not realize that severance packages are often negotiable — especially for longer-tenured employees or those in senior roles. Here are the most effective strategies for negotiating a better severance deal:

Before Signing — Take Your Time

You are never required to sign a severance agreement immediately. In fact, federal law (the Older Workers Benefit Protection Act) gives workers 40 and older at least 21 days to review a severance agreement that includes a waiver of ADEA (age discrimination) claims, plus 7 days to revoke after signing. Use this time wisely.

Key Points to Negotiate

- Increase the Base Amount: Push for 2 weeks per year of service instead of 1, or escalate to a month per year for executive roles

- Health Insurance Continuation: Request COBRA premium subsidies beyond the standard period, or ask for the employer to cover premiums for a set number of months

- Outplacement Services: Career coaching, resume writing, and job placement support can be worth thousands of dollars

- Equity and Unvested Stock: Ask for accelerated vesting of unvested stock options or RSUs

- Non-Disparagement Clauses: Ensure these are mutual — your employer should not be able to bad-mouth you either

- Reference Letter: Request a positive written reference letter as part of the agreement

- Timing of Payment: Negotiate for salary continuation rather than a lump sum if that benefits your UI eligibility in your state

When to Involve an Employment Attorney

If your severance package is large (over $50,000), if the agreement requires you to waive significant legal rights, or if you believe your termination may have been discriminatory or retaliatory, consult an employment attorney before signing. Many employment attorneys offer free initial consultations and take cases on a contingency basis.

8. What to Do After Receiving Severance: A Step-by-Step Action Plan

Here are the most important steps to protect your financial future after a job loss with severance:

- File for Unemployment Immediately: Do not wait — file within the first week of job loss, even if severance may delay your benefits

- Review Your Severance Agreement Carefully: Check for non-compete clauses, non-solicitation agreements, arbitration clauses, and non-disparagement provisions

- Continue or Replace Health Insurance: You have 60 days to elect COBRA; also check the Healthcare.gov marketplace for ACA plans that may be cheaper

- Update Your Budget: Calculate your monthly expenses and how long your severance + savings will last at your current burn rate

- Review Retirement Accounts: You may be able to roll over a 401(k) from your old employer into an IRA — avoid cashing it out to prevent taxes and early withdrawal penalties

- Start Your Job Search Immediately: Even if you plan to take time off, updating your resume and LinkedIn profile should begin within the first week

- Track All Job Search Activity: Many states require UI recipients to document job search efforts each week to maintain eligibility

- Consult a Financial Advisor or CPA: Especially important if your severance exceeds $50,000, as tax planning can significantly affect your net take-home

9. Frequently Asked Questions About Severance Pay and Unemployment

Q: Can I receive both severance pay and unemployment benefits at the same time?

In most states, yes — especially if you received a lump-sum severance payment. However, if your severance is structured as salary continuation, it may reduce or delay your UI benefits during the continuation period. Always file for UI regardless, and let the state agency determine any offset.

Q: Does severance pay affect Pennsylvania unemployment?

Yes, in a specific way. Pennsylvania offsets UI benefits if your severance exceeds 40% of the state average annual wage. The excess amount is prorated over the number of weeks it represents based on your former weekly wage. Benefits begin after this period ends.

Q: How long does severance pay last?

The duration depends on your agreement. Standard severance runs from 1–4 weeks per year of service. Executives may negotiate packages lasting 6 months to 2 years. Salary continuation packages end at the agreed-upon date, after which you may transition to UI if still unemployed.

Q: Is severance pay required if I am laid off?

No. No federal law requires severance for layoffs. Your right to severance depends on your employment contract, a written company policy, a collective bargaining agreement, or a specific promise made by your employer.

Q: What happens to my health insurance after receiving severance?

Your group health insurance typically ends on your last day of employment or the end of that month. COBRA allows you to continue the same coverage for up to 18 months, but you pay the full premium — which can be expensive. Compare COBRA to ACA marketplace plans, especially if your income will drop significantly.

Q: Can my employer take back severance pay?

Generally, no — once severance is paid, it cannot be reclaimed. However, some agreements include clawback provisions if you violate terms such as a non-compete or non-solicitation clause. Read the fine print carefully before signing.

Q: How do I calculate severance pay?

The most common method is weeks of salary multiplied by years of service. For example: 2 weeks per year × 10 years of service × $1,500 weekly salary = $30,000 total severance. Use a dedicated severance pay calculator for more precise estimates based on your state and industry.

Final Thoughts: Protect Yourself After Job Loss

Navigating severance pay and unemployment insurance is complex, and the rules differ dramatically from state to state. Whether you are a worker in Pennsylvania trying to understand the 40% offset rule, a Florida employee wondering why your $275/week UI barely covers rent, or a Georgia professional deciding whether to sign a severance agreement that waives your rights — the most important thing you can do is act quickly, stay informed, and seek professional help when the stakes are high.

Key takeaways to remember:

- Severance is not guaranteed by federal law — it is contractual or discretionary

- Lump-sum severance generally does not prevent you from receiving UI; salary continuation may

- File for unemployment immediately upon job loss — do not wait for severance to finish

- Severance agreements are often negotiable — especially for long-tenured employees

- All forms of severance are taxable as regular income

- State rules vary dramatically — always check your specific state’s Department of Labor website

Use the resources available to you — online calculators, state agency websites, employment attorneys, and HR software tools — to make the most informed decisions possible during what is often a difficult transition.

This guide is for informational purposes only and does not constitute legal or financial advice. Consult a licensed attorney or financial professional for guidance specific to your situation. Laws and regulations are subject to change.